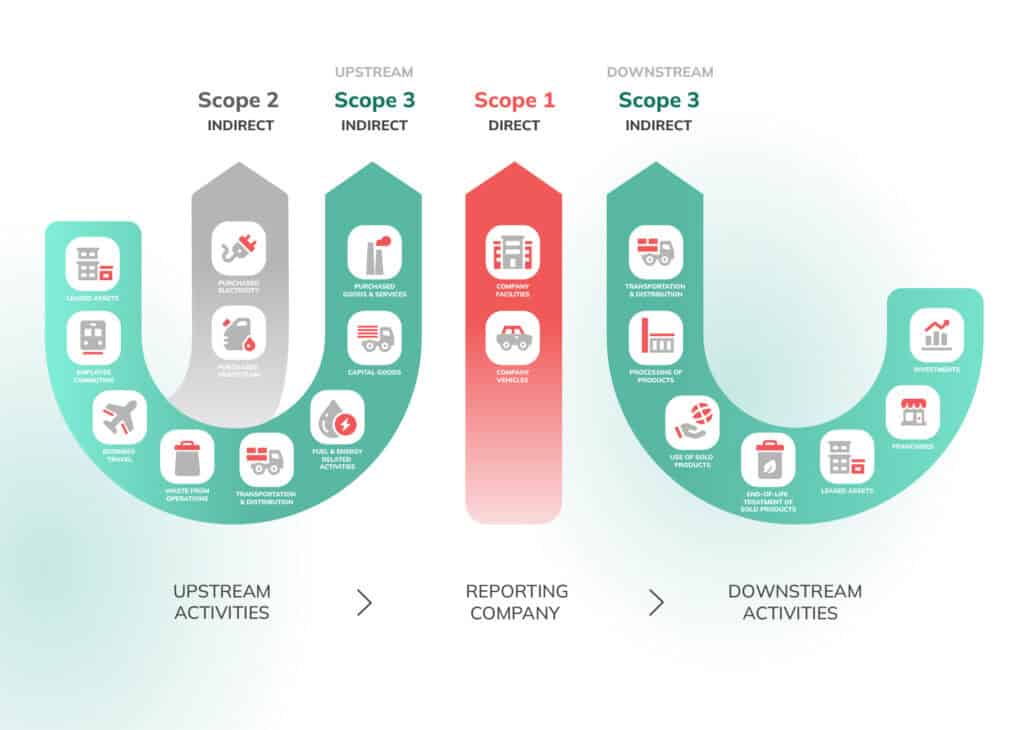

If you’re involved in the bulk commodity supply chain, you’ve likely encountered the growing conversation around Scope 3 Emission Reporting. These emissions represent the indirect greenhouse gas (GHG) emissions generated across your entire value chain, from raw material sourcing to product disposal. Unlike Scope 1 and Scope 2 emissions, which stem from a company’s direct operations and energy use, Scope 3 emissions encompass activities that occur outside your immediate control, such as supplier manufacturing, transportation, customer usage, and end-of-life treatment of products.

At first glance, tackling Scope 3 emissions may seem overwhelming. After all, they often account for the lion’s share of a company’s carbon footprint—up to 75% on average. Yet addressing these emissions is not just a regulatory necessity; it’s a strategic imperative for businesses aiming to thrive in a sustainability-driven economy. For innovative companies in the bulk Commodity supply chain, reducing Scope 3 emissions offers opportunities to enhance supply chain resilience, unlock cost savings, and attract eco-conscious customers and investors.

So, what exactly counts as Scope 3 emissions?

The GHG Protocol provides a valuable framework. It’s a widely recognized standard for accounting for business GHG emissions. This method divides Scope 3 emissions into upstream and downstream sources plus a further 15 sub-categories under these two sources.

For example:

Upstream emissions result from the production of materials and the operation of factories before the creation of final goods. These emissions occur upstream in your supply chain.

Here are all of the categories associated with upstream emissions:

Downstream emissions are those that happen after your product leaves your direct control. These downstream activities are a key part of the overall emissions picture.

Here are all of the categories associated with downstream emissions:

Here’s a breakdown of how different industries compare in terms of their Scope 3 emissions:

| Industry | Key Scope 3 Emission Sources | Emissions Impact |

|---|---|---|

| Oil and Gas | Use of sold products (fuel combustion), upstream fuel extraction, transportation, disposal. | Very High: Dominates total emissions, often 90%+ of the sector's footprint. |

| Utilities (Electricity) | Combustion of sold electricity (coal, gas), upstream fuel extraction and transportation. | High: Life cycle emissions from fossil fuel-based generation dominate. |

| Mining and Minerals | Downstream use of products (e.g., coal burning, steel production), transportation of raw materials. | Very High: Often 100x Scope 1 & 2 emissions. |

| Steel and Metal Manufacturing | Upstream raw material production (e.g., iron ore), downstream product use (e.g., construction, automotive). | High: Traditional methods emit ~2.33 tons CO2/ton steel; circular methods reduce this. |

| Chemical Manufacturing | Raw material procurement, downstream product use (e.g., fertilizers, plastics), transportation. | Very High: Scope 3 accounts for the majority of emissions in this sector. |

| Agriculture and Food Production | Fertilizers, livestock methane, food processing, packaging, distribution, and cooking. | High: Significant upstream and downstream contributions. |

| Transportation and Logistics | Upstream fuel production, emissions from vehicles operated by third parties, infrastructure development. | Moderate to High: Depends on fuel type and logistics efficiency. |

| Automotive Manufacturing | Raw material extraction (metals/plastics), parts manufacturing, vehicle use phase (fuel combustion), recycling/disposal. | Very High: Vehicle use phase dominates emissions profile. |

| Construction and Real Estate | Emissions from construction materials (cement, steel), building operations, demolition. | High: Buildings account for ~90% of Scope 3 emissions in this sector. |

| Textiles and Apparel | Raw material production (cotton/synthetics), dyeing/finishing processes, garment manufacturing, distribution. | High: Fast fashion supply chains drive significant emissions across all stages. |

Scope 3 emissions are more than an environmental challenge—they’re a business risk. Companies that fail to address these emissions face reputational damage, regulatory penalties, and supply chain disruptions. For instance, stringent climate regulations are emerging globally, requiring businesses to disclose and reduce GHG emissions across all scopes.

In Australia, directors face significant penalties for non-compliance with mandatory climate-related reporting requirements, including Scope 3 emissions. These penalties are part of the broader sustainability reporting regime under the Corporations Act 2001 and include both civil and criminal consequences.

So ignoring Scope 3 emissions reporting is not a good idea!

On the flip side, proactive management of Scope 3 emissions can deliver significant benefits. By identifying emission hotspots in your supply chain—such as energy-intensive suppliers or inefficient transportation routes—you can streamline operations and reduce costs. Moreover, showcasing a commitment to sustainability strengthens brand reputation and builds trust with stakeholders. Customers increasingly prefer businesses that align with their values, while investors reward companies with credible plans for reducing their carbon footprint.

Several countries have implemented legislation mandating the reporting of Scope 3 GHG emissions. These laws vary in scope, applicability, and timelines, reflecting the global push for comprehensive climate-related disclosures.

The countries that have implemented Mandatory Scope 3 reporting include:

In addition, there are a number of countries encouraging Voluntary or Material-Based Reporting such as

The Australian Sustainability Reporting Standards (ASRS), implemented under the Corporations Act 2001, require entities to disclose Scope 3 GHG emissions as part of their climate-related financial disclosures.

Some of the key reporting standards and requirements for Scope 3 emissions under ASRS include:

The GHG Protocol allows companies to use methods like industry averages to calculate these totals. The thinking is that using industry averages provides reasonable estimates when precise data is hard to obtain. But is the method flawed and is using averages just defaulting to mediocracy? Lets explore that in more detail.

Using an industry average as a measurement metric can present several challenges and limitations. While it provides a general benchmark, its simplicity often obscures critical nuances and can lead to misinformed decisions.

Some of the key problems associated with relying on industry averages:

At SCIAR we strongly believe the current methods for calculating Scope 3 emissions are severely flawed for Bulk Commodity Producers. These methods are too open to miscalculation as any system would be that relied on guesswork & manual data entry methods. Whilst we understand why these methods are being used, we strongly believe there is a better way going forward.

That is why the team at SCIAR in conjunction with a consortium of the worlds leading companies in the Commodity, Shipping & Carbon Measurement sectors are bringing together all the pieces of the puzzle that will for the first time in the world allow Bulk Commodity producers to accurately show their EXACT Scope 3 emissions for production, transportation, storing, shipping and consumption of their Bulk Commodity.

Accurately measuring and reporting Scope 3 emissions across the entire production-to-consumption lifecycle of a bulk commodity (e.g., metals, coal, or minerals) offers significant strategic, operational, and reputational benefits.

Here are the key advantages:

Enhanced Risk Management

Mitigate Regulatory and Financial Risks: Proactively address tightening global regulations (e.g., EU CSRD, Australia’s ASRS) and avoid penalties or supply chain disruptions.

Improved Stakeholder Trust and Market Positioning

Investor Appeal: Transparent reporting attracts ESG-focused investors, as 44% of companies now set decarbonization targets.

Customer Demand: Meet growing expectations from downstream partners (e.g., steelmakers) needing low-carbon inputs to meet their own Scope 3 goals.

Competitive Differentiation: Companies like BHP and Tata Steel use granular emissions data to lead sustainability rankings and secure contracts in green supply chains.

Cost Savings and Efficiency Gains

Resource Optimization: Digital tools (e.g., process digital twins) reduce waste by reconciling production data with emissions, cutting costs in energy, water, and materials.

Supply Chain Collaboration: Shared emissions data fosters innovation with suppliers, such as switching to low-carbon transport or sustainable extraction methods.

Strategic Decarbonization Opportunities

Targeted Reductions: For bulk commodities, Scope 3 often constitutes >90% of total emissions. Accurate data enables science-based targets (SBTi) and aligns with global net-zero goals.

Circular Economy Integration: Track emissions from product reuse/recycling to design longer-lifecycle commodities.

Regulatory and Compliance Readiness

Audit-Proof Reporting: Centralized, validated data systems streamline compliance with standards like ASRS, IFRS S2, or GHG Protocol.

Avoid Double-Counting: Resolve overlaps (e.g., metallurgical coal used in steelmaking) to ensure accurate disclosures.

Innovation and New Business Models

Low-Carbon Product Premiums: Charge premiums for commodities with verified lower embedded emissions (e.g., green aluminum).

Partnerships: Collaborate with suppliers on carbon capture, renewable energy, or alternative materials to unlock new revenue streams.

Addressing Scope 3 emissions is no longer optional—it’s essential for businesses committed to long-term success in a rapidly evolving world.

For bulk commodity firms, robust Scope 3 reporting transforms sustainability from a compliance burden into a strategic lever. It drives operational efficiency, strengthens stakeholder relationships, and positions companies to lead in decarbonized markets while mitigating transition risk.

At SCIAR we are critical of current Scope 3 emissions calculation methods which we believe are flawed due to reliance on averages, guesswork and manual data entry. To address this, we are collaborating with leading companies in the commodity, shipping, and carbon measurement sectors to develop a groundbreaking new system.

This system aims to accurately measure Scope 3 emissions across the entire lifecycle of bulk commodities, including production, transportation, storage, shipping, and consumption. Such precise tracking would provide strategic, operational, and reputational advantages for bulk commodity companies.

If you would like to know more about this new groundbreaking system then stay tuned to our website for updates in the coming weeks or feel to reach our to schedule a confidential call to discuss.

About the Author

Nick Ogle has have over 30 years of experience in Enterprise IT, spanning roles from engineering, sales to marketing across Australia, the USA, and APJ for various IT vendors. Nick has also founded his own consulting businesses.

Nick is passionate about entrepreneurship and software innovation that drives positive change. Currently, he is the Sales & Marketing Manager at SCIAR Systems, a Newcastle-based SAAS startup, where he is helping commercialize their groundbreaking Bulk Commodity Logistics and ESG software solutions.

Nick is well credentialed to talk about issues in Enterprise IT issues such as Scope 3 Emissions Reporting due to his extensive experience in cloud computing architectures, application design and general industry background in IT.

For more information on Nick and to find articles that have been written on the IT sector in the past, then feel free to look at his LinkedIn profile or browse some of the additional articles Nick has written for SCIAR Systems.